Refinance Loans

Refinance Loans

First Home Mortgage

Mortgage interest rates are at historical lows, and as a such it is a great time for U.S. borrowers to refinance a home mortgage loan. Borrowers consider refinancing for many reasons including obtaining a better interest rate; converting an adjustable rate mortgage to a fixed-rate; debt consolidation; shorten the term of the loan; or other sundry reasons.

There are two primary types of refinancing loans available for consumers – conventional and government-backed loans. There are also state programs available for eligible homeowners.

Conventional Loans

There are several types of conventional home loans. The funding for these loans meet the criteria established by Fannie Mae and Freddie Mac and are insured by private companies. These types of loans are great options for many homebuyers. We offer expertise in the variety of loan options for first-time and repeat home buyers. Let us help you choose the best loan for you and your family.

Fixed Rate

A fixed–rate mortgage (FRM) is a fully amortizing mortgage loan and the interest rate remains the same during the entire term of the loan.

Adjustable Rate

An adjustable rate mortgage is a mortgage wherein the interest rate will vary throughout the life of the loan.

Jumbo

A jumbo mortgage (often referred to as a jumbo loan) exceeds limits established by the Federal Housing Finance Agency. This type of loan is not eligible to be guaranteed, purchases, or secured by Fannie Mae or Freddie Mac.

Government Loans

Government loans are subsidized by the government and protect lenders against defaults on payments. These types of loans make it easier for lenders to offer qualified borrowers lower interest rates. The goal of the government-backed loan is to make home ownership more accessible for lower-income households and first-time buyers.

FHA

An FHA loan is insured by the Federal Housing Administration (FHA). Designed for low and moderate income borrowers, this type of loan is issued by an FHA-approved lender. An FHA loan will have lower minimum down payments and often lower credit score requirments that a conventional loan.

VA

A VA loan is a home mortgage that is available for eligible Active Duty service members, United States Veterans, National Guard and Reservists, and surviving spouses. These loans are guaranteed by the U.S. Department of Veteran Affairs and are issued by qualified lenders.

USDA

A USDA loan is an 100% financing option for qualified low to moderate income homebuyers in eligible rural and suburban areas. These types of loans are backed by the USDA Rural Guaranteed Housing Loan Program.

Phone

+1 (443) 417-2351

Quick Quote

Your New Loan is Just A Click Away

Quick Quote

Your New Loan is Just A Call Away

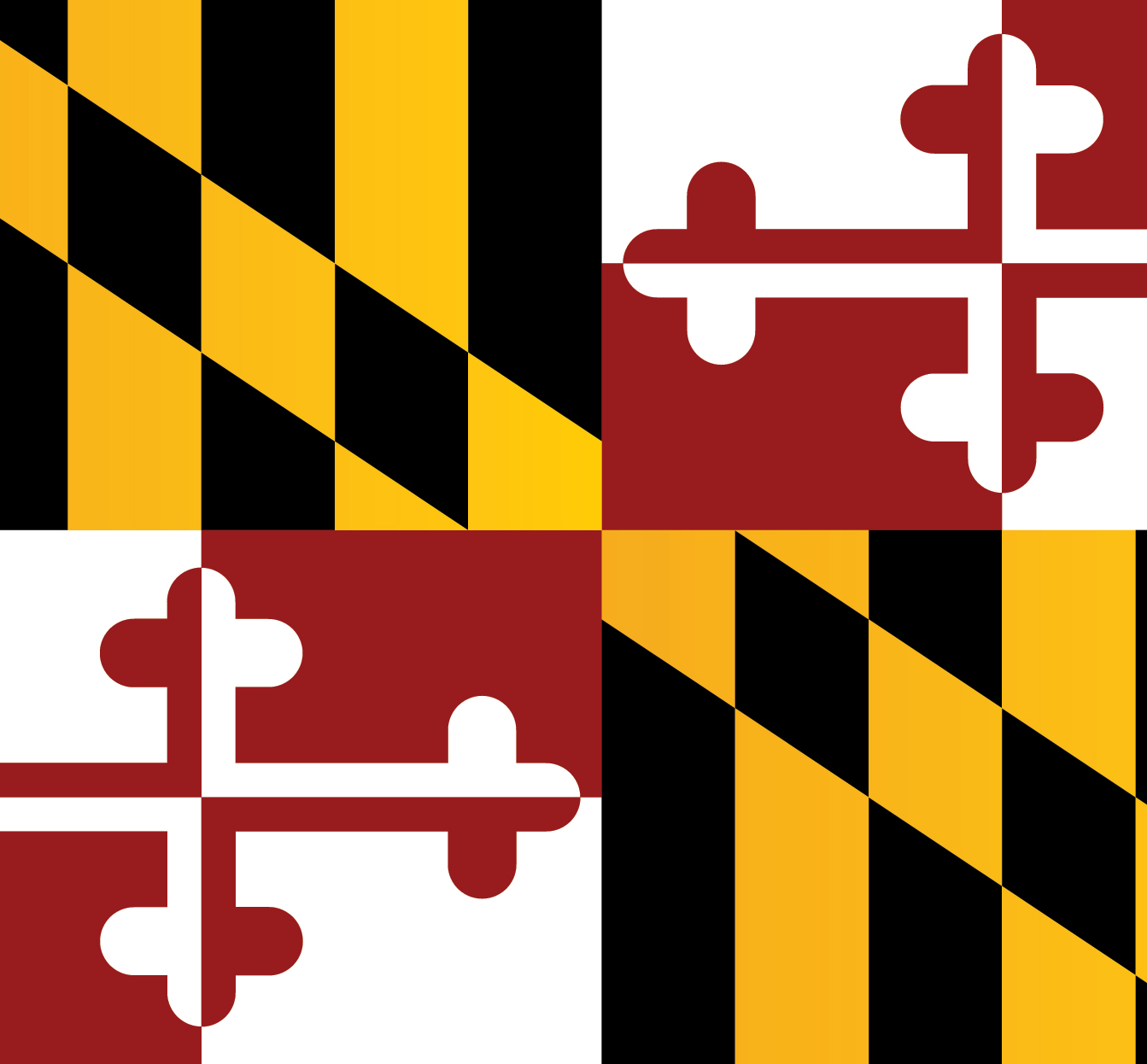

Maryland Mortgage Assistance

Other Lending Programs

Maryland Mortgage Assistance Program

The Maryland Mortgage Assistance Program is designed to help make down payments and mortgage payments more affordable for qualified borrowers.

The MMP offers eligible first-time home buyers a special “1st Time Advantage” loan.

Maryland Home Credit. provides eligible homebuyers with a federal tax credit valued at 25% of the mortgage interest payments (up to $2,000) that may be claimed annually for the life of the loan*. *Please conslut tax advisor.

Ask Us About Other MMA opportunities.

Income restrictions, minimum credit scores, CDA program requirements and qualifications apply.